“ This isn’t incremental advisory. It’s about building enduring, investor-ready companies from day one.”

EARLY STAGE BIOTECHS | VENTURE CAPITAL | PHARMA SERVICES

| EARLY STAGE BIOTECHS

| VENTURE CAPITAL

| PHARMA SERVICES

Tay Salimullah

Founder Renovamen Advisors ®

Our Advisory

Biotech is at a crossroads

Scientific innovation is accelerating, but the gap between discovery and commercial viability is widening. Capital is constrained. Regulatory and pricing complexity is rising. And investors are demanding more than data, they want de-risked, executable business models.

Renovamen Advisors was built for this moment.

We partner with biotech teams and investors to align breakthrough science with commercial viability and partner expectations from day one: Reviving strategy, Regenerating commercial models, and Recharging how value is created in early-stage biotech.

With deep operational experience and a proven track record from lab to launch, we help you align science with strategy, accelerate growth, and bring transformative therapies to patients worldwide.

Premier biotech strategy firm supporting the path to market for advanced therapeutics

Early and growth-stage commercial support for investors and biopharma companies

Led by Tay Salimullah: 25 years of experience and $5B recent global launch success

Deep expertise across gene therapy, cell therapy, and emerging therapeutic platforms

Unique combination of operator experience and investor perspective

Global commercial fluency with a sharp focus on pricing and access, US and ex-US

Premier biotech strategy firm advancing novel therapeutics to market

Commercial support for investors, seed-stage and growth biotechs

25+ years’ experience with $5B+ in global commercialization success

Deep domain expertise in gene therapy, cell therapy, and advanced modalities

Dual lens: seasoned operator and active investor

Global access fluency — including US and ex-US payor strategy

The Biotech Challenge

Escalating development costs

Complex regulatory pathways

Sophisticated market access requirements

Need for innovative pricing models

Global market intricacies

Managing investor expectations

Ensuring complex therapeutics reach patients worldwide

Advising investors and CEOs to de-risk complexity early, embed commercial thinking from the bench to the boardroom and accelerate the path from breakthrough to patient impact.

Advising investors and CEOs to de-risk complexity early, embed commercial thinking from the bench to the boardroom and accelerate the path from breakthrough to patient impact.

The Renovamen Approach

Biotech’s future will be shaped by those who solve for science, strategy, and access in parallel not in sequence.

- Codify the value narrative and differentiated positioning

- Clarify inflection points to focus time, capital, and talent

- Navigate investor conversations with strategic coherence

- Build credible near-term and long-range milestones

- Pressure-test go-to-market assumptions and capital needs

- Align clinical and data strategy to commercial value and strategic interest

- Define the critical capabilities for each stage of growth

- Support founder-CEO transitions and elevate team decision-making

- Enable investor readiness through disciplined execution and smart partnering

Our Services - Recent Success Stories

- $95 M Series A Raise

Challenge:

First-time CEO needed an investor-ready story, early pricing, and a pivot roadmap from seed to clinical-stage.

Solution:

Built pitch deck, value narrative, revenue model, and access thesis aligned to Series A investor expectations.

Result:

Secured 3 term sheets and closed $95 M Series A after 70+ investor meetings — helping launch the company from stealth.

- $8.7 B AveXis Acquisition

Challenge:

A first-in-class gene therapy required premium pricing and global scalability amid evolving regulatory and deal dynamics.

Solution:

Designed commercial model, pricing architecture, and launch strategy across 50+ markets, including key ex-US revenue drivers.

Result:

Generated $5 B+ in global revenue and supported $8.7 B acquisition by Novartis.

- $1 M+ Pharma Services Contract

Challenge:

A pharma services firm needed a U.S. growth engine and playbook to expand globally across biotech accounts.

Solution:

Built BD strategy, asset-rights framework, and pitch positioning aligned to biotech partner expectations.

Result:

Secured $1 M+ contract and a multi-asset development mandate.

- $5 M Seed: Access Platform NewCo

Challenge:

Advanced therapies faced affordability and access barriers; the U.S. market lacked a scalable solution.

Solution:

Advised on company creation aligning payer, provider, and manufacturer incentives into a next-gen access platform.

Result:

Raised $5 M seed from a16z to incubate and scale the model (currently in stealth mode).

Our Client Experience

Our Experience

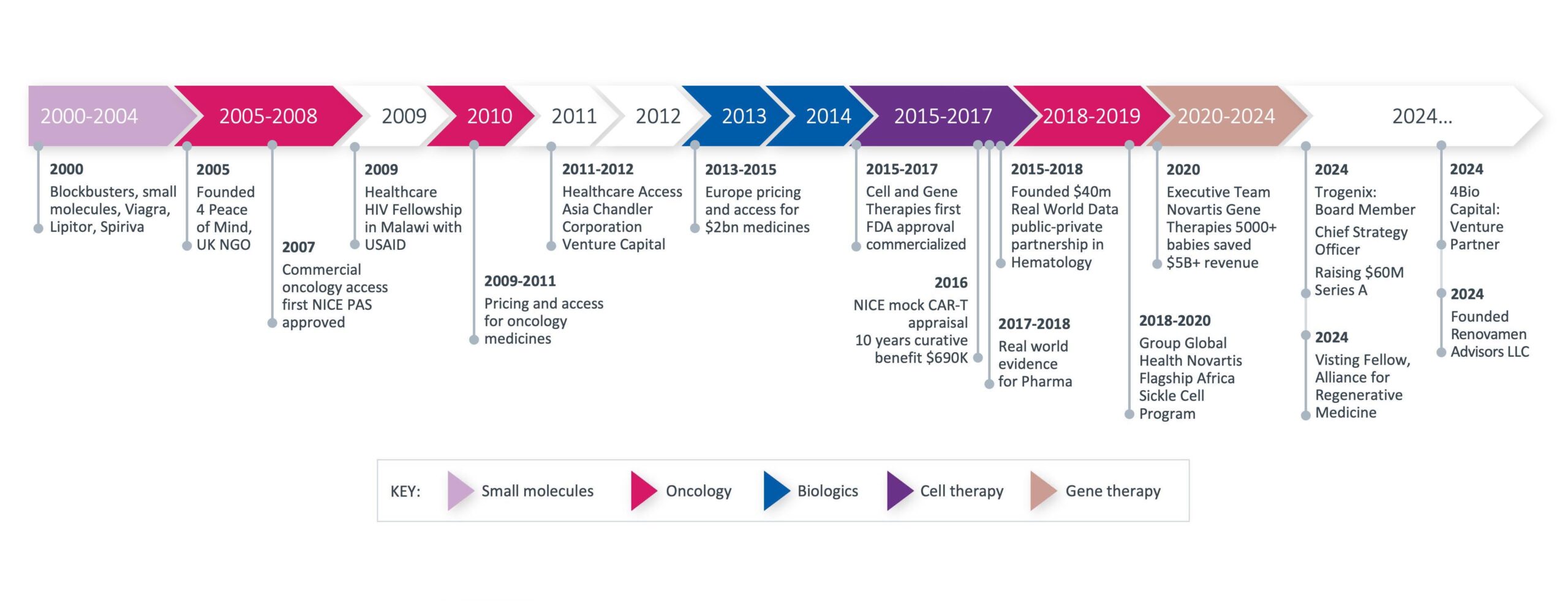

Tay Salimullah is Managing General Partner of Renovamen Advisory® LLC and a Venture Partner at 4BIO Capital®, supporting early-stage biotech and investor teams at the intersection of scientific innovation and commercial execution. A former executive at Novartis Gene Therapies®, Tay helped transform AveXis® into a global leader in advanced therapies, pioneering the commercial model for Zolgensma®—approved in 55+ countries, with over 4,000 patients treated and $5B+ in cumulative revenue. He previously held a variety of investment and healthcare roles, including a decade at Pfizer in strategic and commercial roles. Tay currently serves as Chief Strategy Officer and Board member at Trogenix®, advancing AAV-based oncology gene therapies. A Fellow of the Alliance for Regenerative Medicine®, he brings deep expertise in rare disease, gene therapy, and global commercialization. He holds a BSc in Business Management from Brunel University, London, and completed executive education in Venture Capital & Private Equity at Imperial College London.

Tay Salimullah is Managing General Partner of Renovamen Advisory® LLC and a Venture Partner at 4BIO Capital®

Read More

Supporting biotechs and investors to turn scientific breakthroughs into scalable, capital-efficient platforms with clear paths to value creation. A former executive at Novartis Gene Therapies®, Tay played a pivotal role in transforming Zolgensma® generating $5B+ approved in 50+ countries, treating over 4,000 patients. Prior to that, he spent over a decade in strategic and commercial roles at Pfizer and across healthcare investments.

He currently serves as Chief Strategy Officer and Board Member at Trogenix®, advancing AAV-based oncology gene therapies. He is Executive in Residence at Alliance for Regenerative Medicine®, where he contributes to global access policy, investor engagement, and next-generation pricing models. His work centers on turning high science into scalable, investor-aligned execution.

He holds a BSc in Business Management from Brunel University, London, and completed executive education in Venture Capital & Private Equity at Imperial College London.

- Chief Strategy Officer & Board Member, Trogenix

- Executive in Residence, Alliance for Regenerative Medicine

- Board & Executive Advisor, iECURE

- Commercial Advisor to Biotech and Pharma Service Providers

- Former Executive Team Member, Novartis Gene Therapies

News & Contact

Summary

We help biotech companies and investors to close the execution gap — with clarity, operational precision, and conviction.

- Strategic advisory for investor readiness and value inflection

- Fractional commercial leadership across product, partnerships, and market planning

- Tailored support for company buildout, financing, and partnering

- Deep fluency in pricing, access, and value strategy

- Proven commercial success with 10+ multibillion-dollar global launches

- Trusted partner to VC firms, boards, and clinical-stage executive teams

Revive your strategy

Regenerate your roadmap

Recharge your next phase

We help biotech companies and investors

to close the execution gap — with clarity, operational precision, and conviction.

Revive your strategy

Regenerate your roadmap

Recharge your next phase

- Strategic advisory for investor readiness and value inflection

- Fractional commercial leadership across product, partnerships, and market planning

- Tailored support for company buildout, financing, and partnering

- Deep fluency in pricing, access, and value strategy

- Proven commercial success with 10+ multibillion-dollar global launches

- Trusted partner to VC firms, boards, and clinical-stage executive teams

Get In Touch

Chicago

+1 (862) 210 0355

[email protected]

Quick Links